Startup Funding Opportunities Unlocked for Growth

Startup Funding Opportunities dives into the essential financial lifeblood that fuels innovation and growth in the business world. Without adequate funding, even the most promising startup ideas can falter, making it crucial for entrepreneurs to understand the various paths available to secure capital. This exploration not only covers the different stages of funding but also highlights the global landscape, providing insight into how startups can leverage these opportunities to thrive.

From venture capital to crowdfunding, the funding spectrum is rich with options that cater to diverse needs and stages of growth. Startups can benefit from understanding the nuances of each funding type and preparing effectively to attract the right investors. Furthermore, building strong networks and navigating legal requirements are pivotal in securing the necessary resources for success.

Overview of Startup Funding Opportunities

Startup funding refers to the financial resources that entrepreneurs seek to launch and grow their business ventures. It plays a critical role in enabling startups to develop their products, enter markets, and scale operations. Access to adequate funding can significantly enhance a startup’s potential for success, offering the necessary capital for innovation, hiring talent, and marketing efforts.The journey of a startup generally progresses through various funding stages, each designed to cater to the immediate needs of the business as it evolves.

These stages typically include seed funding, Series A, Series B, and beyond. At the seed stage, entrepreneurs often seek early investments from friends, family, or angel investors to validate their business idea and develop prototypes. As the startup matures, it may attract venture capital during Series A funding to scale operations and enhance product offerings. Series B and later rounds often focus on expanding market reach and increasing revenue streams.

Each of these stages represents a critical juncture in a startup’s life cycle, where strategic funding decisions can make or break the business.

Global Landscape of Startup Funding Opportunities

In today’s interconnected world, the global landscape of startup funding presents a diverse array of opportunities across different regions. Numerous countries have established thriving ecosystems that support startups through various funding mechanisms, including venture capital, crowdfunding, government grants, and accelerators.The importance of these funding opportunities can be illustrated by examining key regions known for their vibrant startup cultures:

- North America: The United States, particularly Silicon Valley, remains a leading hub for startup investments, with venture capital firms aggressively funding tech startups. The availability of high-net-worth individuals and institutional investors fuels this growth.

- Europe: Countries like Germany and the United Kingdom have seen significant increases in venture capital funding. Initiatives such as the European Investment Fund support innovative businesses and foster collaboration among tech hubs.

- Asia: The rise of major tech markets in China and India has led to rapid increases in startup funding. Notably, the Chinese government has implemented policies to stimulate entrepreneurship, resulting in a surge of venture capital activity.

- Africa: The African startup ecosystem is gaining traction, supported by both local and international investors. Initiatives aimed at developing technology hubs in cities like Nairobi and Lagos are paving the way for increased funding opportunities.

Global funding statistics indicate a growing trend in venture capital investments, with billions of dollars poured into startups annually. According to data from Crunchbase, global venture funding reached approximately $300 billion in 2021, showcasing the increasing appetite for innovative business models across the globe.

“Access to funding is vital for startups to experiment, innovate, and ultimately succeed in competitive markets.”

Understanding the diverse funding avenues across different geographies can empower entrepreneurs to make informed decisions. By aligning their business strategies with the funding landscape, startups can optimize their growth potential and navigate the complexities of securing financial support.

Types of Funding Available

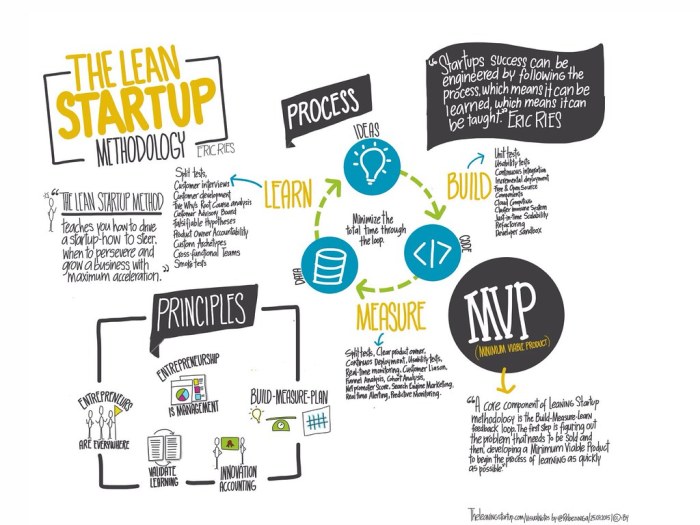

Source: startupgeeks.it

When it comes to fueling the growth of startups, understanding the different types of funding available is crucial. Each funding source offers unique advantages and challenges that can significantly influence the trajectory of a business. Startups can tap into a variety of funding avenues including venture capital, angel investors, crowdfunding, and even grants from government programs. This section will dive into these options, providing insights into what they entail and how they can benefit new businesses.

Venture Capital

Venture capital (VC) refers to funds that are invested in startups and small businesses with high growth potential. VCs not only provide capital but also bring valuable expertise and networks to the table. Typically, venture capitalists seek equity in exchange for their investment, which means they take a stake in the company.

Angel Investors

Angel investors are affluent individuals who provide financial support to startups in exchange for equity or convertible debt. Unlike venture capitalists, angel investors often invest their personal wealth and can offer mentorship and advice based on their own entrepreneurial experiences.

Crowdfunding

Crowdfunding is a method where startups raise small amounts of money from a large number of people, typically via online platforms. This approach not only provides financial support but also validates the business idea and helps to build a community of supporters.

Comparison of Funding Types

To better understand the advantages and disadvantages of each funding type, here’s a comparison table:

| Funding Type | Advantages | Disadvantages |

|---|---|---|

| Venture Capital | Large amounts of capital, valuable connections, and expertise. | Loss of equity and control, high expectations for growth. |

| Angel Investors | Flexible terms, mentorship opportunities, and personal interest in success. | Potentially less funding than VCs, varying investment levels. |

| Crowdfunding | Access to capital without equity loss, market validation. | Time-consuming, requires a strong marketing campaign. |

Grants and Government Programs

Grants and government programs are an essential funding avenue for startups, especially in their early stages. These funds are typically non-repayable and can be a game-changer for businesses that meet specific criteria. Government grants often target sectors like technology, healthcare, and renewable energy, providing funding that can be used for research, development, and operational costs. Startups can also benefit from government programs that offer mentorship, resources, and networking opportunities, fostering an ecosystem for growth and innovation.

Programs such as the Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) are excellent examples that provide funding opportunities alongside technical support.

“Grants can provide a financial cushion without the burden of repayment, allowing startups to innovate and grow sustainably.”

Preparing for Funding

Securing funding is a critical milestone for any startup. However, attracting investors requires a well-thought-out approach that includes a comprehensive business plan, solid financial statements, and an engaging pitch. Each of these components plays a vital role in convincing potential investors of your startup’s viability and growth potential.

Essential Components of a Business Plan

A robust business plan is more than just a document; it’s a blueprint for your startup’s future and a tool to attract investors. Key elements to include in your business plan are as follows:

- Executive Summary: A concise overview of your business, including mission statement, product or service offering, and basic information about your team and financials.

- Market Analysis: A detailed examination of your target market, industry trends, and competitive landscape to demonstrate market opportunities.

- Organization and Management: Artikel your business structure, ownership, and the management team’s background and expertise.

- Marketing Strategy: Explain how you plan to attract and retain customers, detailing your sales and marketing channels.

- Funding Request: Clearly state how much funding you need and how you plan to use it, including future financial projections.

- Financial Projections: Provide a realistic forecast of your financial performance for at least three to five years, including profit and loss statements, cash flow projections, and balance sheets.

Checklist for Preparing Financial Statements

Preparing accurate financial statements is crucial when seeking funding. A well-organized set of financial documents can instill confidence in investors. Here’s a checklist to ensure you have everything covered:

- Profit and Loss Statement: Summarize revenues, costs, and expenses to show net profit over a specific period.

- Balance Sheet: Present a snapshot of your company’s assets, liabilities, and ownership equity at a specific point in time.

- Cash Flow Statement: Track cash inflows and outflows to demonstrate your company’s liquidity and financial health.

- Break-Even Analysis: Determine the sales volume at which total revenues equal total expenses, showing when you expect to start making a profit.

- Tax Returns: Include tax returns for the past few years to provide a historical perspective on financial performance.

Best Practices for Pitching to Investors

An effective pitch can make or break your chances of securing funding. To engage potential investors, consider the following best practices:

- Tailor Your Pitch: Customize your pitch to resonate with the specific interests and backgrounds of each investor you meet.

- Be Clear and Concise: Present your business idea succinctly, focusing on the value proposition and market opportunity in the first few minutes.

- Showcase Your Team: Highlight the skills and experiences of your team members that make them capable of executing the business plan.

- Use Visual Aids: Incorporate slides or graphics to illustrate key points, making complex information easier to digest.

- Practice Your Delivery: Rehearse your pitch multiple times to build confidence and ensure a smooth presentation.

“Investors invest in people, not just ideas.”

Networking and Building Relationships

In the vibrant world of startups, networking plays a pivotal role in securing funding opportunities. Building strong relationships within the startup ecosystem can lead to invaluable connections and insights that propel a startup toward success. Engaging meaningfully with industry peers, mentors, and potential investors helps to create a supportive network that fosters growth and innovation.Establishing a network requires strategic engagement with various stakeholders in the ecosystem.

Startups should consider avenues such as industry events, online platforms, and collaborative spaces to connect with potential investors. By actively participating in discussions and sharing experiences, entrepreneurs can highlight their ventures and attract attention from those interested in funding opportunities.

Strategies for Networking

To effectively network within the startup ecosystem, entrepreneurs can adopt several strategies that enhance their visibility and foster relationships with potential investors:

- Attend Startup Events: Participating in conferences, meetups, and networking events provides direct access to investors and fellow entrepreneurs. Events like TechCrunch Disrupt and Startup Grind are excellent for showcasing ideas and meeting potential backers.

- Leverage Social Media: Platforms like LinkedIn, Twitter, and even specialized online communities allow entrepreneurs to connect with investors and share updates about their startups. Engaging in discussions and sharing valuable content can attract attention from potential funders.

- Join Professional Associations: Being part of industry-specific associations can facilitate connections with seasoned entrepreneurs and investors. Organizations such as the National Venture Capital Association (NVCA) provide resources and networking opportunities.

- Participate in Workshops and Seminars: Engaging in educational sessions not only enhances knowledge but also helps in making connections with speakers and participants who may be investors or mentors.

Role of Incubators and Accelerators

Incubators and accelerators serve as critical hubs in the startup ecosystem, offering resources and connections that can lead to funding opportunities. These programs often provide structured mentorship, access to networks, and sometimes direct funding for startups.Incubators typically focus on nurturing early-stage startups, providing them with office space, resources, and mentorship to refine their business model. Accelerators, on the other hand, usually run fixed-term programs that culminate in a demo day, where startups pitch to a room full of investors.

Notable examples include Y Combinator and Techstars, which have helped launch numerous successful companies.

Events and Platforms for Investor Connections

A variety of events and online platforms exist where startups can meet potential investors. These settings are designed to foster connections and provide a space for startups to present their ideas. The following list details some noteworthy events and platforms that facilitate networking opportunities:

- Startup Grind Global Conference: An annual gathering of entrepreneurs and investors that emphasizes relationship-building and sharing insights.

- Pitch Competitions: Events where startups present their business ideas to a panel of judges and investors. Examples include the Startup World Cup and local pitch competitions.

- Angel Investor Networks: Online platforms like AngelList provide startups a venue to connect with angel investors looking for new opportunities.

- Industry-Specific Trade Shows: Events such as CES for tech startups or Natural Products Expo for food-related businesses attract relevant investors and industry professionals.

Navigating Legal and Regulatory Challenges

Source: pixabay.com

When venturing into the world of startup funding, understanding the legal and regulatory landscape is crucial. Startups often encounter various legal challenges that can hinder their ability to secure funding. Navigating these complexities requires awareness and proactive measures to ensure compliance and safeguard your business interests.One major hurdle for startups is the array of legal issues that arise during the funding process.

Startups must address a range of challenges, including intellectual property rights, employment agreements, and compliance with securities regulations. These issues can significantly impact a startup’s ability to attract investors and secure funding. It’s essential for founders to seek legal advice early on to mitigate risks and ensure that they are operating within the law.

Common Legal Issues in Funding

Startups must be aware of several common legal issues when seeking funding. These include:

- Securities Law Compliance: When raising capital, startups must comply with securities laws, which regulate how securities are offered and sold. Non-compliance can lead to severe penalties and damage investor trust.

- Intellectual Property Protection: Protecting intellectual property is vital for startups. Failing to secure patents or trademarks can jeopardize the business’s competitive edge and deter potential investors.

- Contractual Agreements: Clear and comprehensive agreements with investors are essential to avoid misunderstandings. This includes terms regarding investment amounts, rights, and obligations.

- Employment Law Issues: Startups must navigate employment laws, ensuring compliance with regulations related to hiring, wages, and benefits, to avoid legal disputes.

Importance of Compliance in Fundraising

Compliance is not just a legal requirement; it’s a foundation for building trust with investors. Adhering to securities laws ensures that all fundraising activities are transparent and ethical. Violations can lead to severe financial repercussions and reputational damage. Compliance also fosters a positive relationship with potential investors, as they are more likely to engage with startups that demonstrate a commitment to legal and ethical standards.

Role of Contracts and Agreements

Contracts and agreements serve as the backbone of funding arrangements. They provide clarity and security for both the startup and the investor. Essential components of these agreements include:

- Investment Terms: Clear specifications regarding the amount invested, equity stakes, and rights attached to investments.

- Confidentiality Clauses: Protect sensitive business information shared during the fundraising process.

- Exit Strategies: Artikel the conditions under which investors can exit their investment, ensuring expectations are managed.

- Dispute Resolution: Mechanisms for addressing disagreements should they arise, which can save time and costs in the long run.

“A well-structured contract not only defines the terms of the investment but also establishes a foundation of trust between the startup and its investors.”

Trends in Startup Funding

The landscape of startup funding is continually evolving, shaped by economic shifts, technological advancements, and innovative financial models. Emerging trends reflect not only the current challenges faced by entrepreneurs but also the opportunities presented by new funding avenues. Understanding these trends is crucial for startups seeking to navigate the dynamic funding environment.One significant trend is the rise of decentralized finance (DeFi), which has transformed traditional funding models.

DeFi leverages blockchain technology to create financial systems that operate without centralized intermediaries, offering startups alternative avenues for capital raising. This shift allows for peer-to-peer lending, tokenized assets, and automated smart contracts, which can lower costs and improve accessibility for startups.

Rise of Decentralized Finance (DeFi)

Decentralized finance is redefining how startups access funding. By removing intermediaries, startups can reach potential investors directly, often through Initial DEX Offerings (IDOs) or token sales. This model is particularly beneficial for tech startups and those in emerging industries, allowing them to tap into a global investor base.

- Increased Accessibility: DeFi platforms allow startups to raise funds from a diverse pool of investors, regardless of geographical boundaries.

- Lower Costs: Traditional fundraising methods often involve significant fees for intermediaries. DeFi reduces these costs, making it more financially viable for startups.

- Tokenization of Assets: Startups can tokenize equity or assets, providing new ways for investors to engage with their offerings.

Impact of Economic Conditions on Funding Availability, Startup Funding Opportunities

Economic fluctuations have a profound impact on the availability of funding for startups. During economic downturns, investors may become more risk-averse, leading to a tightening of capital and making it more challenging for startups to secure funding. Conversely, in a booming economy, increased investor confidence can result in greater funding opportunities.

- Market Sentiment: Positive economic indicators often lead to increased investment in startups as venture capitalists seek high-growth opportunities.

- Interest Rates: Low interest rates can stimulate funding availability, while higher rates may deter investment due to increased costs of capital.

- Government Incentives: Economic conditions can lead to government initiatives aimed at supporting startups, providing grants or tax incentives that enhance funding access.

Technology Shaping Fundraising for Startups

Technology plays a pivotal role in shaping the future of fundraising for startups. Innovations such as crowdfunding platforms, blockchain technology, and artificial intelligence are empowering entrepreneurs and transforming the funding landscape.

- Crowdfunding Platforms: Websites like Kickstarter and Indiegogo enable startups to raise capital through small contributions from a larger group of people, democratizing access to funding.

- Blockchain for Transparency: Blockchain technology enhances transparency in fundraising, allowing investors to track the use of their funds and ensuring assurance in the legitimacy of the startup.

- AI in Investor Matching: Artificial intelligence tools can analyze investor preferences and match them with startups that align with their interests, streamlining the fundraising process.

“The future of startup funding is being shaped by technology, transparency, and the increasing demand for decentralized financial solutions.”

Case Studies of Successful Funding

Source: staticflickr.com

Successful funding is not just about the amount raised; it’s about the strategies employed, the relationships built, and the lessons learned along the way. Startups that have navigated the complex landscape of funding successfully often have compelling stories that provide insights into their journey. Here, we explore notable case studies of startups that secured significant funding and the strategic maneuvers they undertook.

Examples of Startups That Secured Funding

Several startups have stood out for their innovative approaches to securing funds. These examples illustrate various strategies used to attract investors and validate business models.

1. Uber

Initially launched as a ridesharing service, Uber raised approximately $25 billion over multiple rounds from 2010 to 2019. Their strategy included leveraging technology to enhance user experience and aggressive market expansion, which attracted venture capitalists eager to invest in a platform with vast growth potential.

2. Airbnb

Starting in 2008, Airbnb faced skepticism but successfully raised an impressive $6 billion by 2020. Their unique approach combined community engagement with a user-friendly platform, allowing them to build trust among users and investors alike. They fostered relationships with early adopters who became brand evangelists.

3. Stripe

Launched in 2010, Stripe has become a leading payment processing company, raising over $2 billion by 2021. Their focused pitch on solving complex payment issues for developers resonated with investors. They showcased their technology’s scalability and potential to dominate the fintech space, appealing to both early-stage and later-stage investors.

Comparison of Funding Rounds and Amounts Raised

Understanding the funding landscape also involves looking at how much capital these startups raised across various rounds. The following table illustrates the funding rounds and amounts raised by notable startups.

| Startup | Seed Round | Series A | Series B | Series C | Total Raised |

|---|---|---|---|---|---|

| Uber | $1.5M | $11M | $37M | $1.2B | $25B |

| Airbnb | $20K | $600K | $7.2M | $1.5B | $6B |

| Stripe | $2M | $18M | $40M | $150M | $2B |

Lessons Learned from Failed Funding Attempts

Not all funding attempts end in success. The startup community is rich with lessons derived from failures. Understanding these pitfalls can provide valuable insights for future entrepreneurs.

Lack of Clear Value Proposition

Many startups fail to articulate their unique value within a competitive market. This often leads to investor disinterest.

Insufficient Market Research

Startups that do not thoroughly understand their target audience or market gaps frequently struggle to secure funding. Investors want to see a solid business case backed by data.

Poor Financial Planning

A lack of detailed financial projections can signal to investors that a startup is unprepared or lacks a viable path to profitability.

Weak Team Dynamics

Investors often assess team cohesion and expertise. Startups with a disorganized or inexperienced team are less likely to gain the trust needed to secure funding.

“The road to funding is paved with lessons learned from both successes and failures.”

Conclusion

In conclusion, navigating Startup Funding Opportunities is vital for entrepreneurs aiming to bring their visions to life. By understanding the types of funding available, preparing diligently, and fostering valuable connections, startups can position themselves for success in a competitive landscape. These strategies not only enhance the likelihood of securing funding but also lay the foundation for sustainable growth and innovation in the future.

Commonly Asked Questions

What are the main sources of startup funding?

The primary sources include venture capital, angel investors, crowdfunding, and government grants.

How can I prepare my startup for funding?

Prepare a comprehensive business plan, ensure your financial statements are in order, and practice your pitch to investors.

What role do incubators play in startup funding?

Incubators provide mentorship, resources, and networking opportunities, helping startups connect with potential investors.

What are common legal challenges startups face in funding?

Startups often encounter issues related to compliance with securities laws, contract negotiations, and intellectual property rights.

How can technology influence startup fundraising?

Technology is reshaping fundraising through online platforms, enabling wider access to investors and innovative funding models like DeFi.